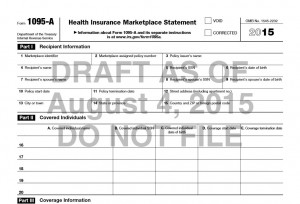

Did you get your 2015 health insurance through the Hawai‘i Health Connector (or another marketplace)?

Filing your taxes is more important than ever.

Everyone who had insurance through the Hawai‘i Health Connector in 2015 MUST file their 2015 income taxes. And even if you missed the initial filing deadline, IT’S NOT TOO LATE!

“Even through the tax filing deadline of 4/18 has passed, if you had health insurance through the Hawaii Health Connector in 2015 and you received financial help paying for your premiums, you still need to file your tax return to continue receiving this important benefit during the next open season” ~Gayvial James, IRS Taxpayer Advocate

You must file taxes to preserve your ability to receive help with health insurance in 2017, even if you had no income or have not had to file in the past.

You can get more information from the IRS on its website. Healthcare.gov also provides assistance you can access via its website. The Taxpayer Advocate Service provides important information about how advanced premium tax credits (APTC) affect you and the important of filing taxes in a special webpage on these credits.

Click here for frequently asked questions. Helpful resources for filing your taxes. Did you receive a letter from the IRS? Click here! 2014 Medical Premium Calculator (Silver Level) 2015 Medical Premium Calculator (Silver Level) 2014 Medical Premium Calculator (Bronze Level) 2015 Medical Premium Calculator (Bronze Level)